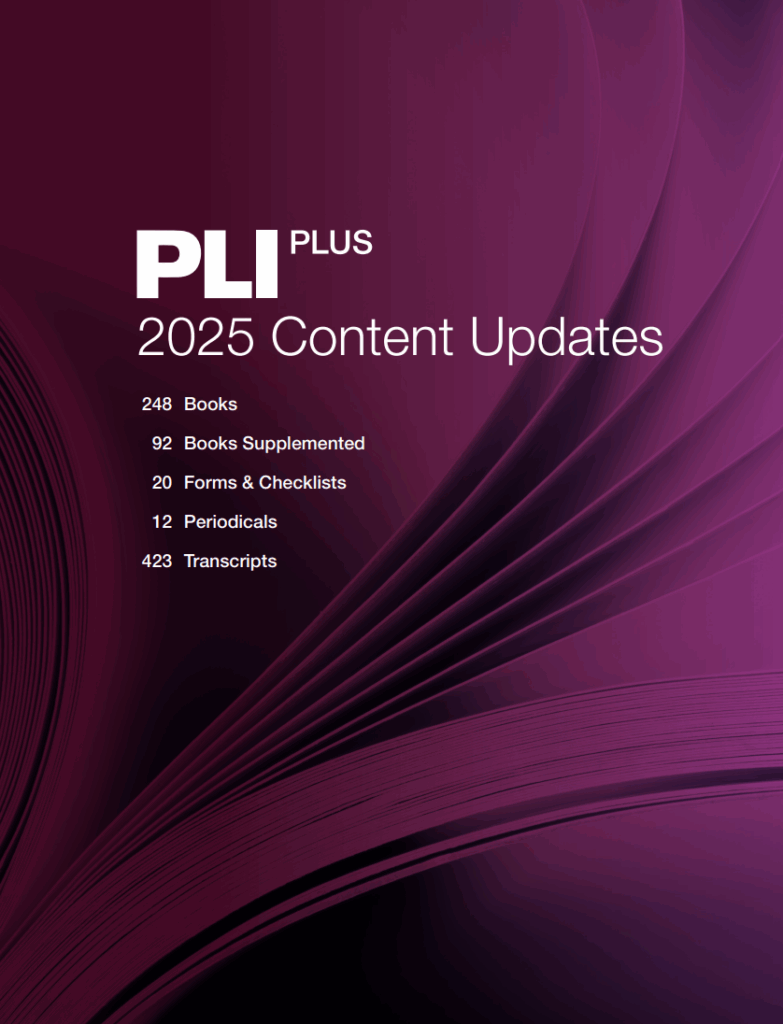

We add content to PLI PLUS every month to ensure our subscribers have access to the most up-to-date and relevant secondary source legal documents. Renowned legal experts regularly update our acclaimed Treatises, Skills Books, Practice Guides, Course Handbooks, Case Summaries, Transcripts, and Forms to reflect recent changes and developments in the law.

Click here to see what we added in February 2026!